YOUR COMPETITIVE ADVANTAGE.

SUSTAINABLE BUSINESS MODEL

Keeping up

with the trends

The economy and society are undergoing profound change. Aareal Bank actively helps to shape this transformation process.

The financial services sector is facing tremendous challenges: new technologies, new ways of working and new market participants, not to mention new regulations that change the financial markets in lasting and profound ways. More than ever before, banks are being called upon to question their business models, and to continuously develop them in light of sustainability considerations.

That is why we are following the changes on our markets – and the trends that go hand-in-hand with them – very closely, and are considering their implications seriously. It is only by anticipating developments at an early stage and by translating them into innovative products and services for our clients that we can attain the market position we are striving for and rise to the challenge we have set for ourselves.

The many issues that we are currently considering include, for example:

what are the developments on the property markets – particularly in terms of ESG – and how can we benefit from them,

how can we take greater advantage of data by using artificial intelligence and in so doing add value for our clients, and

what opportunities does the platform economy hold and what products and services can we use to cater for this trend.

Work life and home life are increasingly merging. This calls for new property concepts.

During recent decades, the logistics sector has evolved from a set of pure transport and storage processes into a global network of production and distribution centres.

Property trends

The Covid-19 pandemic has influenced the property markets considerably over the past financial year and created a great deal of uncertainty. It can be assumed that this uncertainty will persist for some time to come. However, we are confident that the property markets will normalise again as soon as the economy returns to its usual rate of growth. Ultimately, the demand for property remains intact.

Individual asset classes will perform differently in the years ahead, however. Yet these differences are not so much a result of the pandemic than an expression of trends that emerged some time ago and merely gained momentum as a result of the Covid-19 crisis.

Logistics properties

Logistics is a growth market with great potential. As such, the logistics sector will continue to play a decisive role in shaping the economy in the future. That means rising demand for logistics properties – especially those that are centrally located with good infrastructure. The rising demand is also being met with a limited supply of space, creating attractive growth prospects for investors.

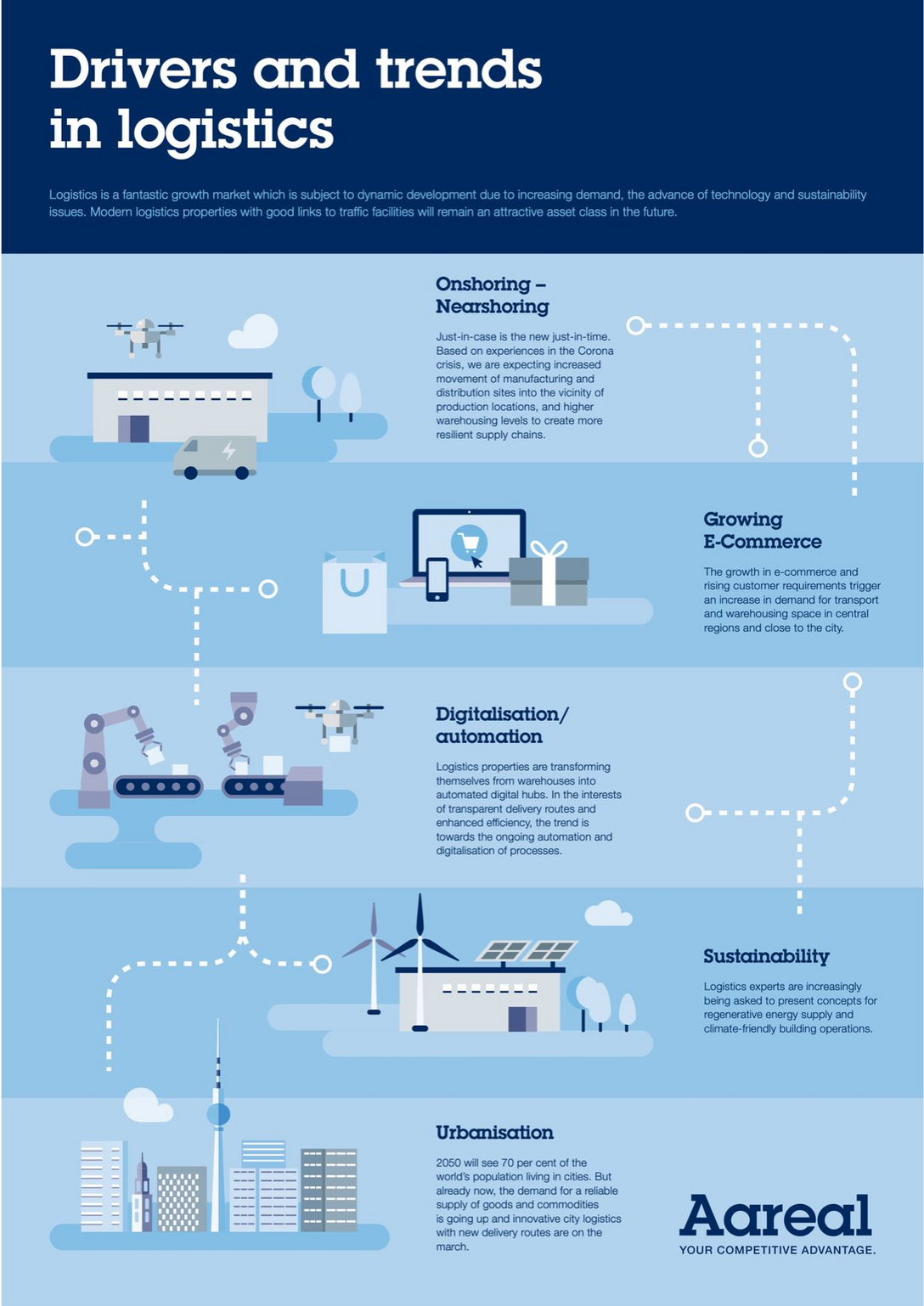

Drivers and trends in logistics

Our info chart outlines the key drivers for the logistics sector.

Logistics properties

Our white paper on “Logistics Properties” explains why investing in logistics properties is more attractive than ever.

Hotel properties

Even though hotel properties were hit hardest by the coronavirus pandemic, in terms of occupancy, they remain amongst the most sought-after investment asset classes. We do not believe that this is a structural crisis. In the future, we will once again travel and take advantage of the services of hotels. That is why hotels are amongst the properties that will recover the fastest once the economy normalises.

Retail properties

In the retail asset class, the Covid-19 pandemic has acted as a catalyst, accelerating changes that had been emerging for quite some time, particularly due to e-commerce. Once the coronavirus pandemic has been overcome, consumers will once again focus on professionally managed, prime brick-and-mortar retail properties offering an experience in top locations. Hence, this segment will continue to hold opportunities.

Office buildings

Office buildings have experienced many changes. The lines between “life”, “home” and “work” are being increasingly blurred, creating new challenges for office buildings. Properties with future-proof designs in attractive locations continue to offer strong potential in this asset class.

Severin Schöttmer, Managing Director Special Property Finance, explains in a video what makes Aareal Bank special when it comes to financing logistics properties.

Student Housing

Student accommodation offers attractive growth potential, as outlined in our “Student Housing” white paper.

Will everything remain different?

Prof. Dr Kerstin Hennig (EBS Real Estate Management Institute) and Severin Schöttmer (Aareal Bank) talk about the development of the asset classes.

Artificial intelligence

Artificial intelligence (AI), along with blockchain technologies, is one of the key future technologies within the financial services industry. In combination with structured data analysis, it presents banks with numerous different possibilities to unlock new revenue streams and provide even better quality services at a lower cost.

We see a variety of different application areas for AI: it can help to increase efficiency, improve risk management, support lending decisions, identify new findings about sectors and markets and enhance how our products and services perform. That is why we are already employing certain smart tools that use AI technology, especially with regard to clustering and structuring large amounts of data.

“There’s hardly any issue that will have a bigger impact on both FinTech companies and the established financial sector over the next several years as data. To be able to develop application areas and ultimately business models based on that, we need to stop siloed thinking and act in a coordinated fashion as a whole company. That is the foundation for AI’s success.”

Established in 2016, the Frankfurt-based TechQuartier is a cross-sector innovation platform which brings together start-ups and established enterprises.

The goal of the “Financial Big Data Cluster”, which is subsidised by public funds, is to build a cloud-based data platform for the financial services sector.

Driven by continuous technological innovation, the requirements for modern IT infrastructure keep rising.

In 2020

Aareon’s AI-based virtual assistant

Neela was introduced to the market.

“Artificial intelligence is on the cusp of evolving from a megatrend to a central application area in established sectors. We see tremendous potential in the use of AI solutions to level up established business areas and develop new ones.”

To take advantage of the vast array of opportunities, we have been working with a range of AI experts for several years, including our partnership with Rocketloop, a start-up specialising in individual machine learning and AI. As part of our collaboration, we developed an innovative news crawler in 2020 that scans available property markets information on the web and provides it, bundled with different analysis tools, to our Credit Risk department. We are currently using this AI tool to help support our retail property financing activities in the UK.

“For us, Neela’s added value is not a purely cost-related consideration. We want to use her to boost our brand – to provide a better, wider-ranging service for tenants and offer a customer touch point far superior to the norm.”

At present we are prioritising other potential applications for AI and are adapting our existing data architecture. At the same time, we are constantly developing our IT infrastructure through targeted sub-projects so that it not only provides the appropriate performance level and flexibility for AI solutions to be widely used, but also so that it can live up to the needs of a modern banking IT landscape overall. It is just as important, however, that our employees have the right mindset and the necessary qualifications. That is why we will be tailoring staff development and collaborations with technology partners in this area in the years to come.

In 2020, Aareon’s AI-based virtual assistant Neela was introduced to the market. As part of the initial launch phase, Neela was introduced as a chatbot. The functionality enables property companies in particular to automatically answer their clients' frequently asked questions. The benefits: clients can get answers quickly and conveniently, employees are freed up by not having to answer frequently asked questions and therefore have more time for complex issues.

Neela is the virtual assistant provided by Aareon. Driven by artificial intelligence and equipped with state-of-the-art chatbot functionality and dialogue technology, Neela communicates ‘personally’ with tenants. Click here to find out more (in German only).

Neela, the virtual assistant

Meet Neela, Aareon’s AI-based virtual assistant: click here to start a chat.

Platform economy

“Sometimes, it is necessary to be able to integrate new solutions quickly. That’s precisely what the Aareon Smart Platform makes possible. It enables us to add value for our customers and their partners; and we derive benefit too from using the service ourselves and being able to enhance the loyalty of our customers.”

Over the past several years, platform companies have been amongst the fastest growing enterprises. Their business model is based primarily on making selling, buying or creating products and services simpler and bringing together market participants on a platform. These platforms, which become more attractive the more offerings and users they unite, are becoming more successful in the financial services sector as well as the property and housing industry.

Aareon is a pioneer in the provision of B2B platforms for the property sector. Roughly 20 years ago, Mareon was launched as a way to connect property companies and tradespeople and Mieter Portal has been on the market for over five years. Aareon Smart Platform was introduced in 2019: as an open platform, this allows clients and partners to develop solutions and transfer them into Aareon Smart World.

Lars Ernst, Managing Director Group Banking & Digital Solutions at Aareal Bank, and Dr Mark Steffen Walcher, Managing Director of smartlab, discuss the cooperation between the two companies (in German only).

“Customers want to have a range of simple and secure payment methods when it comes to paying their rent too. Integrating PayPal into the Aareal Exchange & Payment Platform enables companies to connect with more than 370 million PayPal clients worldwide and offer their clients the option of paying the way they want to.”

Aareal Exchange & Payment Platform is Aareal Bank Group’s trailblazing platform solution. The focus of this B2B platform solution is optimising processes between housing companies and different payment services. With its help, payments in the property and housing industry can be transacted on one common platform using internet-based payment methods Barzahlen / viacash, PayPal or credit cards in addition to traditional options like cash, bank transfers or direct debit. The central integration of different payment services into the underlying ERP processes efficiently allows to pay for various housing services using alternative payment methods, which means housing companies can expand the range of services they offer to their tenants. Surveys very clearly indicate growing demand and expectation for these payment services in the property and housing sectors.

In addition, with Aareal Connected Payments we partnered with the platform provider smartlab to develop an automated invoicing procedure which is initially being used in the e-mobility arena. The procedure makes it easier to manage the invoices for complex payment flows between different partners, so-called multi-party payments, on a shared platform. Aareal Connected Payments is used on the ladenetz.de platform. It enables electric car owners to charge their vehicles with a single charging card across Germany and makes it possible for the more than 220 connected municipal utilities to automatically and simply settle accounts amongst themselves.

Prof. Dr Philipp Sandner, Head of the Frankfurt School Blockchain Center, and Daniel Höfelmann, Director, Innovation Management at Aareal Bank, outline the potential that Blockchain technology holds for the financial services sector (in German only).

“We entered into a pioneering partnership with Aareal Bank that we can thank for making client processes considerably more efficient. Customers are left with minimum effort and costs, and we are able to focus on our core expertise, i.e. developing services surrounding e-mobility for municipal utilities and business partners.”

“The pressure to innovate is rising in the housing sector. Companies are increasingly facing the need to cut costs, develop new revenue models and re-invent themselves to some extent in response to changing tenant demands. At the same time, the housing sector doesn’t have to overcome all of these challenges alone. Innovating is easier when working with the right partner. That may be newer market participants like start-ups, service providers like banks or even companies in related industries. The future of residential living and services has to be imagined by sectors and stakeholders together.”

The Future of Payment

Our “Future of Payment” microsite offers more information on Aareal Bank's innovative platform solutions (in German only).

Tomorrow’s payments

Our info chart takes a look at the future of payments (in German only).

![[Translate to English:]](../fileadmin/_processed_/b/6/csm_aareal_navi-teaser_konzern@2x_f3a163abdc.png)

![[Translate to English:]](../fileadmin/_processed_/f/e/csm_aareal_navi-teaser_transaktions-highlights@2x_475e048233.png)