YOUR COMPETITIVE ADVANTAGE.

Sustainable

economic activity

Sustainability, digitalisation, new technologies: the financial sector is undergoing profound changes.

A sustainable transformation is underway in our society and the economy, at top speed. Companies are working around the clock, and around the globe, to adjust their value chains to meet the requirements of sustainability. Clients and investors, shareholders and employees, social stakeholders and political decision-makers alike expect companies and other organisations to help build a future in which economic, ecological and social issues fit together harmoniously.

Through comprehensive sustainability management, Aareal Bank Group attuned itself to these trends years ago. As a bank and partner to the property industry, we are active in two sectors that are instrumental as the economy transforms – the financial sector, which has a key role to play in promoting sustainable development, and the property industry, which is of tremendous importance to achieving the climate targets set by the EU.

More detailed information on our strategic approach to sustainability is available here.

The increasing importance of sustainability is also enhancing the requirements for climate-friendly building operations. This applies to shopping centres, hotels, logistics properties and offices as well as to residential units.

Alice Stolzenburg from our Strategy team helped to establish Aareal Bank's Sustainability Management initiative in 2012. With our ESG@Aareal initiative launched in 2020, we are now firmly and systematically embedding ESG aspects in all our processes.

Embedding ESG even deeper

As a major player in the market, we are aware of our special responsibility. It is our ambition to help shape ESG developments in our market, i.e. concerning environmental, social and governance criteria. This is reflected in our business strategy: With Aareal Next Level, we have formulated a sustainable strategy that purposefully takes up and integrates ESG requirements.

But we are not yet where we want to be. Going forward, we want to combine financial and non-financial objectives to an even greater extent for our corporate management, and systematically embed ESG aspects in our mindset and all our processes. Our goal is to continue to receive good rating results and awards for our approach to sustainability, as we have done in the past.

Our rating results are available here.

ESG criteria

Environment

Taking environmental aspects into account – such as climate protection, biodiversity, or the sustainable use of natural resources.

Social

Maintaining and promoting social standards, safety at work, fair wages, and fundamental democratic principles.

Corporate governance

Respecting the fundamental principles of good corporate governance, such as tax honesty and the prevention of corruption.

ESG@Aareal

That is why we will continue to pursue a stronger integration of ESG in our business strategy with Aareal Next Level, and why we launched ESG@Aareal in 2020. ESG@Aareal serves to systematically gather the current and future sustainability expectations of our clients and other stakeholders, and match them with our own ambitions. This allows us to identify the changes our strategy, our products, our risk management, our communications, IT and reporting require. Above and beyond this, we have a focus on ESG regulation and what this means for our business models.

One of the most important goals of ESG@Aareal is systematically identifying ESG business potential: we want to seize the many opportunities that the sustainable transformation of society and economy holds for us. This includes developing new products, adjusting existing offerings and providing ESG-oriented financial instruments, e.g. green lending products. ESG@Aareal will not only enable a full integration of ESG requirements into our processes, but also make a significant contribution to Aareal Bank Group’s future viability, together with our Aareal Next Level strategy.

As the growing importance of ESG factors triggers numerous and profound changes, ESG@Aareal will have an impact on nearly all of Aareal Bank Group’s value creation processes. ESG@Aareal therefore follows a holistic approach, integrating almost every division. This serves to ensure that we will achieve our goal of embedding ESG even further, as an integral part of our strategy and our DNA.

Separate Combined Non-financial Report 2020 of Aareal Bank AG

Our non-financial report is available here.

Core action areas

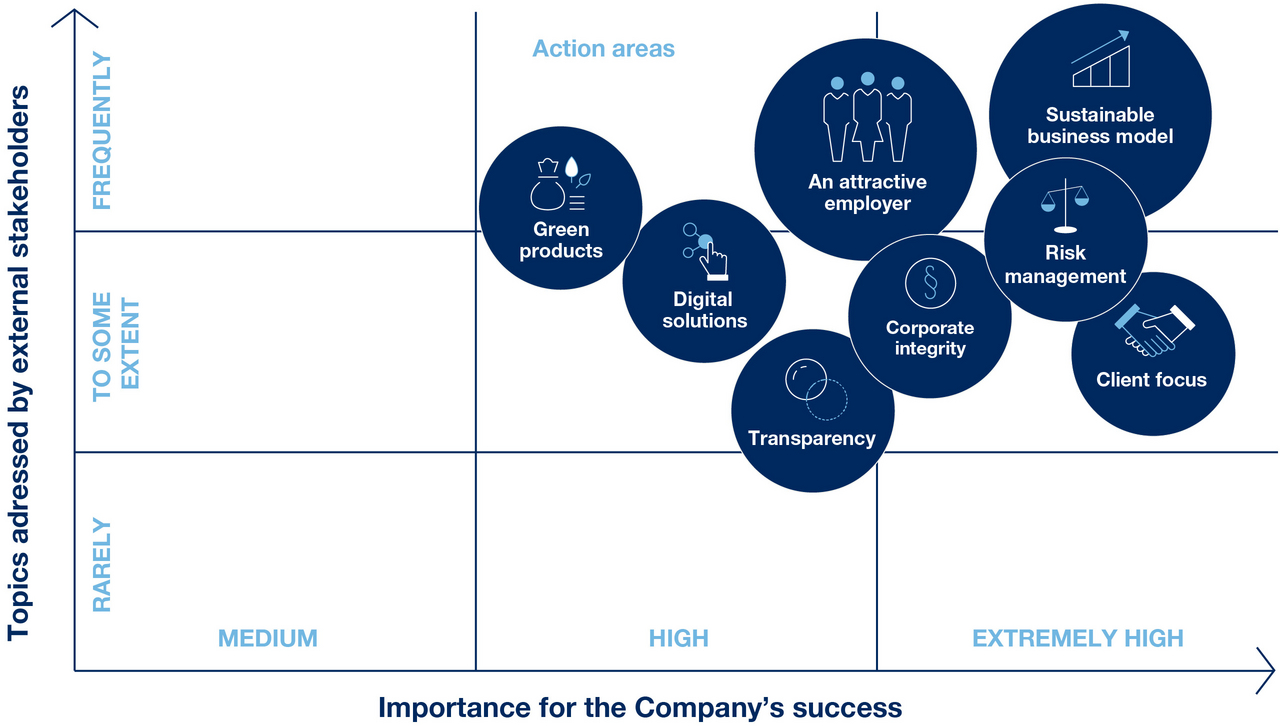

Our sustainability strategy comprises the following core action areas:

Sustainable business model

Client focus

Risk management

Corporate integrity

Attractive employer

Transparency

Digital solutions

Green products

These topics are of particular importance to us. To determine, cluster, and prioritise them, we regularly hold structured discussions with both our stakeholders and representatives from different divisions of the Group, which we then use to build our materiality matrix:

The following sections will deal with the topics that hold the greatest relevance for both our stakeholders and us (“extremely high” importance).

Keeping up with the trends

The economy and society are undergoing profound change.

Aareal Bank actively helps to shape this transformation process.

Cooperation as a driver of success

No success without cooperation. Aareal Bank counts on a dialogue rooted in partnership, on co-creation, and intensive dialogue with start-ups.

Responsibility is not a buzzword

Ethics and yield are closely linked. Long-term success is only open to those treating humans and nature with respect.

Controlled offensive

Seizing opportunities – without losing sight of the risks. The more complex the world becomes, the more efficient risk management must be.

Living differently, working differently

Re-defining work. Aareal Bank not only addresses innovative working models and continuous learning – but also the issue of carbon emissions.

![[Translate to English:]](../fileadmin/_processed_/b/6/csm_aareal_navi-teaser_konzern@2x_f3a163abdc.png)

![[Translate to English:]](../fileadmin/_processed_/f/e/csm_aareal_navi-teaser_transaktions-highlights@2x_475e048233.png)