YOUR COMPETITIVE ADVANTAGE.

INTEGRITY

Responsibility

is not a

buzzword

buzzword

Ethics and yield are closely linked. Long-term success is only open to those treating humans and nature with respect.

Running a business means assuming responsibility, for society, the environment, employees, and owners. Today, in a world that is increasingly interconnected, this is truer than ever. That is why the requirements for an effective integrity and risk culture and corresponding incentive and sanctions mechanisms have significantly increased in recent years.

For many years, our Code of Conduct has been the foundation of our business practices. The Code of Conduct sets out binding rules for legal and ethical conduct, and defines our fundamental understanding of how we work together, corporate and social responsibility, as well as fair employment and working conditions. At the same time, the Code of Conduct serves as the basis for many other policies and measures at our Company to help ensure that we conduct ourselves in a way that is ethically and morally right. This includes safeguarding fair working conditions and respecting human rights.

Our Code of Conduct is the foundation of our business practices.

A confidential (and anonymous) whistle-blowing channel also exists that can be used to report suspected breaches of the rules, fraudulent behaviour, or white-collar crime to the Compliance department. This guarantees whistle-blowers confidentiality and protection. In addition, an externally run whistle-blower system was established as a separate process for Aareal Bank in 2020. Employees can use this voluntary, confidential reporting system to raise concerns online or by phone ‒ including anonymously, if desired.

To continue to meet the ever increasing requirements for upright conduct and integrity, we are currently working on:

further strengthening our risk culture,

connecting our ESG targets more strongly with our remuneration systems, and

implementing our diversity values in our workforce by taking appropriate measures.

Risk culture

Banks live on trust. To retain this trust and prevent illegal or illegitimate business practices in the financial sector, regulators have made risk culture and reputational risk a top priority for all financial institutions.

A company’s risk culture is defined by four factors in particular: leadership culture, employee accountability, open communication / critical dialogue and appropriate incentives.

We are currently refining our approaches to all four of these factors. Over the past two years, we have revised and further fleshed out all of the relevant processes and underlying guidelines, for example by reviewing our Code of Conduct and preparing Human Rights Guidelines. Furthermore, risk culture has been added to the Group strategy as a key element and made an objective for all members of the Management Board.

We are also looking closely into the question of how we can further improve the way we review, measure and then tailor how we strengthen our risk culture. At the same time, we are working on using different event formats to raise awareness amongst our executives and employees about the heightened requirements surrounding our risk culture and to align questions of integrity with our process of cultural change.

“In 2020, Aareal Bank ranked first among MDAX companies in the DVFA Scorecard for Corporate Governance and came in third in the overall ranking. In our communications with shareholders, we rely on transparency and plausibility. This recognition motivates us to continue with our efforts for good corporate governance.”

Setting ESG targets

“The refined remuneration system for the Management Board of Aareal Bank acts as an incentive for aligning the Group’s development more closely with long-term sustainable criteria. A major change in the remuneration system is that sustainability criteria are better integrated with compensation to reflect the growing importance of ESG issues.”

Studies and experience have demonstrated time and again: people are particularly motivated to pursue targets, and to do so systematically, if these targets are linked to a variable remuneration component. Target-based variable remuneration not only provides those responsible with a clear orientation framework and incentives, it also has powerful management and steering implications. Furthermore, this type of target setting shows the importance that is attributed to certain targets in a company.

Because the significance of ESG targets is increasing in our industry, we have decided to take a first step towards systematically anchoring ESG criteria in our Management Board remuneration. To this end, our Management Board remuneration system was refined in 2020 and will be presented to our shareholders for adoption at the next Annual General Meeting.

Going forward, our Annual Report will include the specific ESG targets influencing our Management Board remuneration, together with other parameters. The targets we choose are clearly defined and measurable. To measure and monitor target achievement, KPIs are determined annually for the targets, and their degree of achievement is assessed at the end of the financial year.

As part of our ESG@Aareal initiative, we are currently developing a system of ESG indicators that build upon each other for our Group, analysing our stakeholders’ expectations, and the regulatory changes that are becoming apparent with regard to our sustainability performance. The formulated KPIs serve as the foundation for effectively and comprehensively embedding ESG targets in our executives’ variable remuneration.

Diversity

The Boston Consulting Group has spoken: Aareal Bank Group is a diverse company. For years, we have been at the top end of the consultancy’s Gender Diversity Index, ranking first in 2019 and second in 2020.

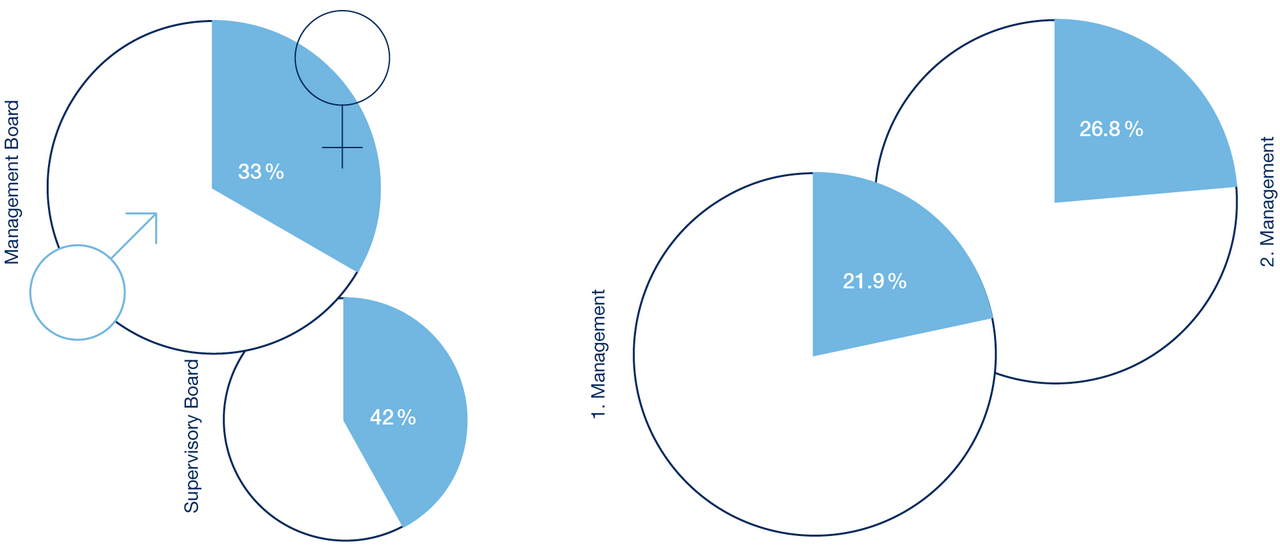

The main reason behind our strong performance is our high share of women at the executive level: on our Management Board, one in three members is female and on our Supervisory Board 42 per cent are women. On the first management level below the Management Board, 13.2 per cent of managers are women. On the second management level, this share rises to 25.5 per cent.

There is a positive correlation between diversity and innovation.

For us, however, diversity does not end with gender. We believe it is important to tackle the wide-ranging challenges we have to meet with wide-ranging experiences and perspectives. We are active internationally – we need international teams. We aim to offer comprehensive consultancy – we need employees from different age groups. We offer a broad range of services – we need employees who bring different professional, personal and cultural backgrounds to the table.

Gender Diversity Index

More information on Boston Consulting Group’s Gender Diversity Index is available here (in German only).

“I highly appreciate the many options Aareal Bank has offered me to help coordinate work and family, including flexible working hours and part-time arrangements, various work-from-home models, support with day care, or a parent-child office.”

“The capital markets have responded very well to our diversity efforts at Aareal Bank Group. In 2020, we joined the Bloomberg Gender Equality Index. This index is limited to only 325 companies from around the world that exceed a globally established threshold defined by Bloomberg to measure gender equality in five areas: female leadership and talent pipeline, equal pay and gender pay parity, inclusive culture, sexual harassment policies and pro-women brand.”

Studies have shown time and again There is a positive correlation between diversity and innovation. In particular where the tasks at hand are complex, such as sustainable or digital transformation, heterogeneous teams are more successful than their homogeneous counterparts because they come up with more and better solutions. And for truly fresh ideas to come into being, people with different ways of life and experiences need to join forces to develop solutions.

Against this background, we are committed not only to paying attention to diversity when recruiting and developing talent, but to setting up our operational processes in such a way that we succeed in including different personalities. Our managers play an important role in this – it is their job to transform people with different experiences and profiles into a powerful team. Going forward, we will pay even closer attention to how successful our managers are at doing so. At the same time, we are offering numerous measures for flexible working arrangements to facilitate reconciling work and family needs, supporting our employees whatever their life situation is. We consider diversity management a core discipline of future-oriented human resources management, and as a key success factor in further expanding our market position.

Bloomberg has also admitted Aareal Bank to its Gender-Equality Index (GEI). Find more about it here.

“What could be more sustainable in HR than hiring and promoting young talent? In 2020, almost half of all hires at Aareal Bank were young talents. I am one of them and I think it’s great that I am being supported in my development and that Aareal Bank is recognising the value of investing in young talent.”

![[Translate to English:]](../fileadmin/_processed_/b/6/csm_aareal_navi-teaser_konzern@2x_f3a163abdc.png)

![[Translate to English:]](../fileadmin/_processed_/f/e/csm_aareal_navi-teaser_transaktions-highlights@2x_475e048233.png)