YOUR COMPETITIVE ADVANTAGE.

Strategy

Aareal Bank Group’s strategy focuses on sustainable business success: we want to continue our long track record of success in the German banking sector in the future whilst generating value for all of our stakeholders.

By successfully implementing our “Aareal 2020” programme for the future, we managed to not only achieve our targets for the year, but also to reposition ourselves substantively, organisationally and culturally. Our Group is now higher performing, more robust, efficient and agile.

Under the guiding principle of “Aareal Next Level”, we continue to evolve the strategic positioning we had been implementing for the Bank since spring 2020, to confront the immense challenges facing the entire financial services sector.

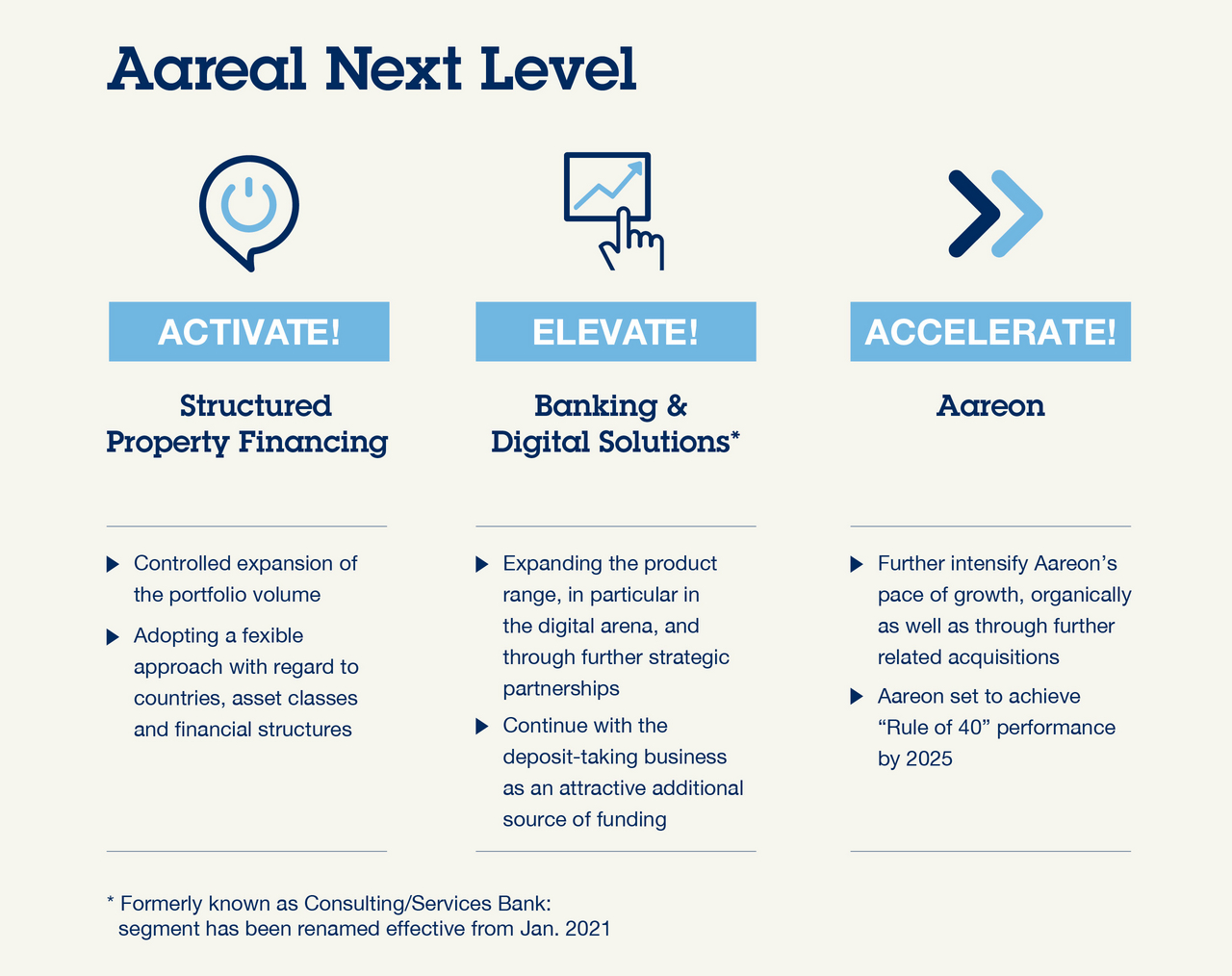

Activate! Elevate! Accelerate!

Our goal with “Aareal Next Level” is to advance Aareal Bank Group to the next stage of its development. This remains unchanged, despite the coronavirus pandemic. The essential results of the 360-degree review that was concluded in early 2021 have confirmed that our strategy and our business model remain viable in a normalised environment, once the pandemic has been overcome. Our focus in future, however, will be even more firmly directed than previously at exploring new potential for growth and greater strategic opportunities, whilst maintaining our proven business model. Excluding any potential acquisitions, this should allow us to generate consolidated operating profit in the range of €300 million in 2023, provided the pandemic has been fully overcome by then and the risk situation has returned to normal again.

Aareal Next Level: geared towards

sustainable business performance.

We see opportunities for profitable growth in all our three business segments. Given that these have different operating frameworks and growth potentials, however, we have also defined different strategic focal points in “Aareal Next Level”. The Structured Property Financing segment is guided by the motto “Activate!”, the Banking & Digital Solutions segment by “Elevate!” and Aareon by “Accelerate!”.

Structured Property Financing

In the Structured Property Financing segment, the controlled, ESG-compliant expansion of the portfolio volume – adopting a flexible approach with regard to countries, asset classes and financing structures – is aimed at making better use of the existing platform. In part, that means systematically using the flexibility developed in recent years in terms of regions, asset classes, structures and exit channels. It also involves expanding our activities along the value creation chain, for example in servicing property financing. We also want to enhance the efficiency of our processes.

Our goal is a controlled, ESG-compliant expansion of the portfolio.

Overall, we seek to maintain our significance – which is quite high – as a property financing provider in the most important markets whilst more closely aligning our business with the changing needs of our clients and markets, in line with business cycles and in a flexible manner. In addition, our goal is to realise the potential of digital business models in the Structured Property Financing segment even further.

We are targeting a portfolio volume of around €29 billion by the end of 2021 and of approximately €30 billion by the end of 2022 – with positive effects for net interest income, which is expected to rise noticeably already in the current year. For the post-Covid period, we anticipate enhanced opportunities for high-margin business whilst maintaining our conservative risk standards.

Banking & Digital Solutions

Under the motto “Elevate!”, we want to significantly expand the Banking & Digital Solutions segment in the years ahead, which combines our activities for the institutional housing industry and related sectors. We are planning to grow our product portfolio and expand into new markets where there is demand for specific expertise in payment transactions. In the process, we intend in particular to take advantage of our deep understanding of our clients’ infrastructures and processes. In addition to the deposit-taking business, we also aim to increase our focus on generating commission income, and to further harness the opportunities that arise there to develop business models together with our clients and other market participants.

A marked increase in net commission income is envisaged between now and 2025. We want to achieve this mainly by expanding the product range, in particular in the digital arena and through further strategic partnerships. We want to continue with our deposit-taking business as an attractive additional source of funding for the Group, with volumes projected to remain above €11 billion over the medium term.

Along the way, we will increase the recognition of the different products and lines of business. In specific terms, this means that Aareal Bank, as the leading provider of payment transaction services for the housing industry, will be expanding. This will enhance transparency of our products and services.

We expand our digital product offering, and anticipate further growth.

Strategic partnerships open up new potential, paving the way for new business models.

Progressive urbanisation and digitalisation are triggering numerous growth impulses in the property industry.

Aareon

The Aareon business segment is a material growth driver for Aareal Bank Group. Aareon AG is recognised as a pioneer in the digitalisation of the European property industry. Under the “Accelerate!” motto, we intend to once again significantly intensify the pace of growth in this segment in the years ahead, organically growing Aareon's business for this purpose. Targeted M&A activities are expected to generate additional growth. Throughout this process, we intend to not only secure the loyalty of our existing client base with an expanded range of products, but also to reach related client groups and target them with our established product portfolio. In addition, we are planning to develop new products for adjacent client groups.

In order to further bolster Aareon’s growth prospects and implement its growth programme more quickly, we entered into a long-term partnership in August 2020 with the financial investor Advent. Within the scope of this agreement, we have sold a 30 per cent minority stake in Aareon to Advent International. Joining forces with Aareal Bank, Advent is set to help further strengthen Aareon’s market position as a leading provider of ERP systems and digital solutions for the European property industry and its partners, and to accelerate Aareon’s value appreciation. The common goal is for Aareon to achieve “Rule of 40” performance by 2025 (meaning that the sum of Aareon's EBITDA margin and revenue growth rate should exceed 40 per cent). Based on the Value Creation Programme jointly developed with Advent – excluding any potential acquisitions – an increase in adjusted EBITDA to around €135 million by 2025 is targeted.

Successful together: combining different skills and expertise leads to the best results.

Especially in conurbations, there is a growing need for digital and sustainable solutions.

Additional levers to sustainably raise profitability

Besides the growth initiatives for the three segments, Aareal Bank Group will use additional levers to sustainably raise its profitability, including an optimisation of the funding mix and the capital structure. In addition, numerous measures are being implemented to enhance the efficiency of the organisational structure, processes and infrastructure. As an example, the “IT Next Level” initiative will reduce complexity in the IT infrastructure, expanding cloud-based applications. In addition, the Group plans to streamline management structures across divisions.

All of the measures combined are projected to lead to a cost/income ratio below 40 per cent in the Bank’s Structured Property Financing segment by 2023, which is in line with a best-in-class ratio on an international level as well. Aareal Bank has budgeted total expenses of around €10 million in its banking business for implementing the strategic adjustments in the years 2021 to 2023; these are however offset by one-off income in a similar magnitude. Aareon expects expenses of approximately €8 million in 2021 for implementing its Value Creation Programme.

New brand positioning

Our new brand positioning, introduced in 2020, also serves to highlight the objectives we are pursuing with “Aareal Next Level”. Our key objective: we want to make our clients more successful, creating a competitive advantage for them. To do so, we are using our extensive expertise and experience, as well as our wide-ranging service portfolio, to offer our clients optimum services that secure long-term competitive advantages for them. We develop integrated offers, tailor-made from scratch to meet our clients' specific demands, and targeting maximum realisation of our clients' potential. This is based on our unique combination of financing services and innovative digital products.

![[Translate to English:]](../fileadmin/_processed_/b/6/csm_aareal_navi-teaser_konzern@2x_f3a163abdc.png)

![[Translate to English:]](../fileadmin/_processed_/f/e/csm_aareal_navi-teaser_transaktions-highlights@2x_475e048233.png)